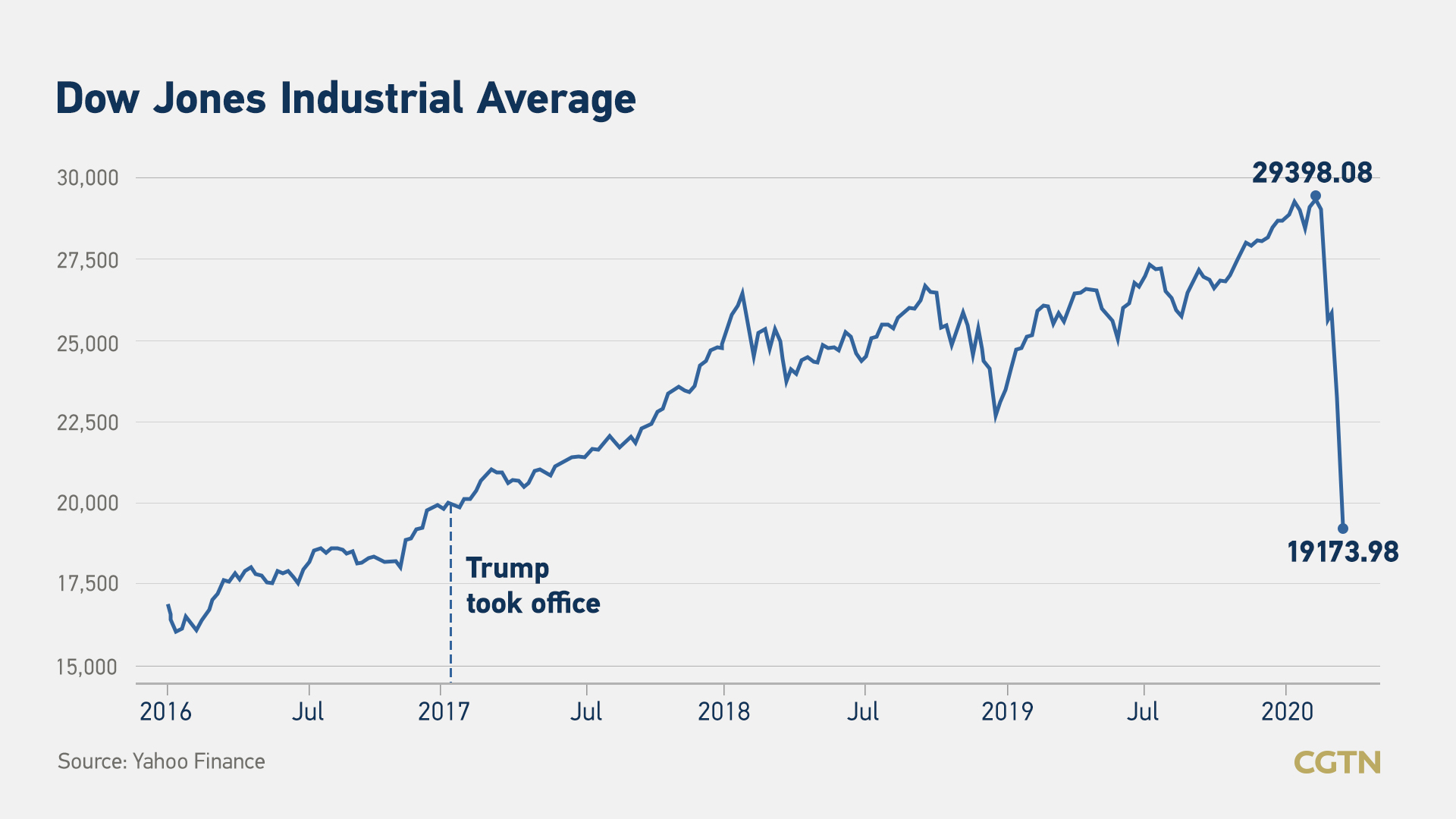

The stock market can be a volatile and unpredictable environment, with market fluctuations occurring rapidly and unexpectedly. To mitigate the impact of extreme market movements, stock exchanges have implemented a mechanism known as circuit breakers. In this article, we will delve into the world of stock market circuit breakers, exploring what they are, how they work, and their significance in maintaining market stability.

What are Stock Market Circuit Breakers?

Stock market circuit breakers are automatic trading halts triggered by significant price movements in the market. These breaks are designed to pause trading activity temporarily, allowing investors to reassess the market and make informed decisions. Circuit breakers are typically activated when the market experiences a sharp decline or rise, exceeding a predetermined threshold.

Types of Circuit Breakers

There are two primary types of circuit breakers:

Level 1 Circuit Breaker: This type of circuit breaker is triggered when the market declines by 7% from the previous day's closing price. Trading is halted for 15 minutes to allow investors to reassess the market.

Level 2 Circuit Breaker: If the market declines by 13% from the previous day's closing price, a Level 2 circuit breaker is triggered, resulting in a 30-minute trading halt.

Level 3 Circuit Breaker: In the event of a 20% decline from the previous day's closing price, a Level 3 circuit breaker is triggered, and trading is halted for the remainder of the day.

How Do Circuit Breakers Work?

Circuit breakers are designed to be triggered automatically when the market reaches a certain threshold. Here's a step-by-step explanation of the process:

1.

Market Monitoring: Stock exchanges continuously monitor the market's performance, tracking price movements and volatility.

2.

Threshold Detection: When the market declines or rises beyond the predetermined threshold, the circuit breaker is triggered.

3.

Trading Halt: Trading is halted for a specified period, depending on the type of circuit breaker triggered.

4.

Market Reopening: After the trading halt, the market reopens, and trading resumes.

Importance of Circuit Breakers

Circuit breakers play a crucial role in maintaining market stability and protecting investors from extreme market fluctuations. By providing a temporary pause in trading, circuit breakers:

Prevent Panic Selling: Circuit breakers help prevent investors from making impulsive decisions, reducing the risk of panic selling and subsequent market crashes.

Facilitate Informed Decision-Making: The temporary trading halt allows investors to reassess the market, consult with advisors, and make informed decisions.

Maintain Market Integrity: Circuit breakers help maintain market integrity by preventing excessive volatility and promoting a more orderly market.

In conclusion, stock market circuit breakers are an essential component of the financial markets, providing a safety net for investors and maintaining market stability. By understanding how circuit breakers work and their significance, investors can navigate the markets with confidence, making informed decisions and minimizing the risk of losses. As the stock market continues to evolve, the importance of circuit breakers will only continue to grow, ensuring a more stable and secure investing environment for all.