The latest Consumer Price Index (CPI) report for December 2024, released by the Bureau of Labor Statistics (BLS), shows a notable increase in core inflation on a month-over-month basis. This development has significant implications for the economy, monetary policy, and consumers alike. In this article, we'll delve into the details of the report, exploring what the numbers mean and how they might influence economic decisions in the coming months.

Key Highlights of the December 2024 CPI Report

-

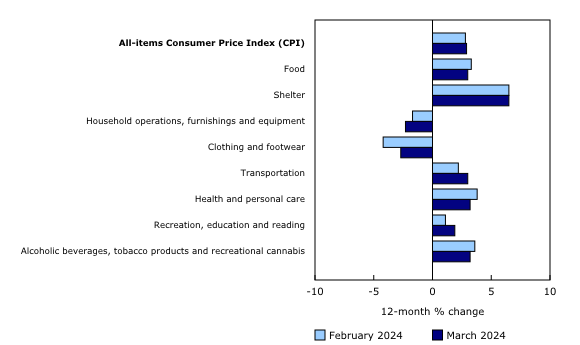

Core Inflation Increase: The core CPI, which excludes volatile food and energy prices, rose by [insert percentage] percent from November 2024 to December 2024. This increase is a key indicator of underlying inflationary pressures in the economy.

-

Total CPI: The total CPI, including all items, also saw an increase, though at a slightly lower rate than the core CPI. This suggests that while there are inflationary pressures, they are somewhat tempered by fluctuations in food and energy costs.

-

Year-over-Year Changes: On a year-over-year basis, both the core and total CPI showed increases, indicating that inflationary trends are persistent, albeit with variations in the rate of change.

Implications for Monetary Policy

The Federal Reserve closely watches inflation data to inform its monetary policy decisions. An increase in core inflation could prompt the Fed to reconsider its stance on interest rates. If inflation continues to rise, especially above the Fed's target rate of 2%, there could be a move towards tightening monetary policy to curb inflationary pressures. This might involve increasing interest rates, which can impact borrowing costs, consumer spending, and overall economic growth.

Economic Outlook and Consumer Impact

-

Growth and Inflation Balance: The challenge for policymakers is to balance economic growth with inflation control. High inflation can erode purchasing power, especially for low-income households, while overly aggressive monetary tightening can slow down economic growth.

-

Consumer Spending: An increase in prices, especially for essential goods and services, can affect consumer spending habits. As prices rise, consumers may choose to cut back on discretionary spending, which can have a ripple effect on various sectors of the economy.

-

Investment and Savings: For investors and savers, rising inflation can mean that the purchasing power of their money decreases over time. This might lead to a shift towards investments that historically perform well in inflationary environments, such as precious metals or real estate.

The December 2024 CPI report, with its indication of rising core inflation, serves as a critical data point for understanding the current state of the economy. As policymakers, businesses, and consumers look to the future, the interplay between inflation, economic growth, and monetary policy will be closely watched. The path forward will depend on a myriad of factors, including future inflation trends, employment rates, and global economic conditions. For now, the increase in core inflation is a reminder of the ongoing challenges in achieving a balanced economic recovery.

Stay tuned for further updates and insights into the evolving economic landscape.