The world of semiconductor stocks has been on a rollercoaster ride in recent years, with the industry experiencing significant fluctuations due to various market and economic factors. For investors looking to capitalize on the potential growth of the semiconductor sector, the Direxion Daily Semiconductor Bull 3X Shares (SOXL) offers an attractive opportunity. In this article, we will delve into the details of SOXL, its performance, and how it can be a valuable addition to your investment portfolio.

What is Direxion Daily Semiconductor Bull 3X Shares (SOXL)?

The Direxion Daily Semiconductor Bull 3X Shares (SOXL) is an exchange-traded fund (ETF) that aims to provide daily investment results, before fees and expenses, of 300% of the daily performance of the PHLX Semiconductor Sector Index (SOX). The SOX Index is a modified market-capitalization-weighted index composed of companies involved in the design, manufacture, and sale of semiconductors.

Key Features of SOXL

Leveraged Exposure: SOXL offers 3x leveraged exposure to the daily performance of the PHLX Semiconductor Sector Index, making it an attractive option for investors who want to amplify their potential gains.

Daily Reset: The fund resets its exposure on a daily basis, which means that the leverage is reset to 3x every day. This allows investors to benefit from the potential upside of the semiconductor sector without having to worry about compounding losses.

Trading Flexibility: As an ETF, SOXL can be traded throughout the day, allowing investors to quickly respond to market changes and adjust their positions accordingly.

Performance and Risks

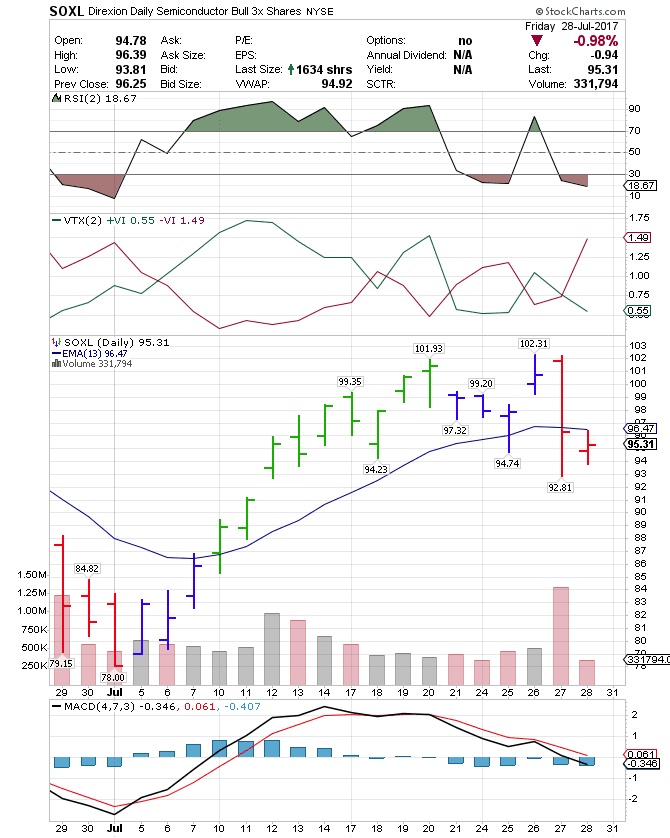

The performance of SOXL is closely tied to the performance of the PHLX Semiconductor Sector Index. Historically, the semiconductor sector has experienced significant growth, driven by the increasing demand for semiconductors in various industries, including technology, automotive, and healthcare. However, the sector is also subject to volatility, and investors should be aware of the potential risks, including:

Market Volatility: The semiconductor sector can be highly volatile, and SOXL's leveraged exposure can amplify losses as well as gains.

Industry Risks: The semiconductor industry is subject to various risks, including changes in demand, competition, and regulatory issues.

The Direxion Daily Semiconductor Bull 3X Shares (SOXL) offers a unique opportunity for investors to capitalize on the potential growth of the semiconductor sector. With its leveraged exposure and daily reset feature, SOXL can be a valuable addition to a diversified investment portfolio. However, investors should be aware of the potential risks and carefully consider their investment goals and risk tolerance before investing in SOXL. As with any investment, it's essential to do your research, set clear goals, and consult with a financial advisor if necessary.

For real-time updates and quotes on SOXL, visit the Nasdaq website. Stay informed and stay ahead of the game with the latest news and analysis on the semiconductor sector and SOXL.

Note: This article is for informational purposes only and should not be considered as investment advice. Investors should consult with a financial advisor before making any investment decisions.