Table of Contents

- How to file tax extension - KimmiKjeilan

- Do I Need to File a Tax Extension?

- S Corp Tax Deadline 2025 Extension Deadline - Michael R. Valentine

- What to do AFTER You File for an Income Tax Extension

- How to File a Tax Extension 2018: Here's How to Get an Extra 6 Months ...

- 2018 Deadline for Federal Income Tax Extension Approaching - Joshua ...

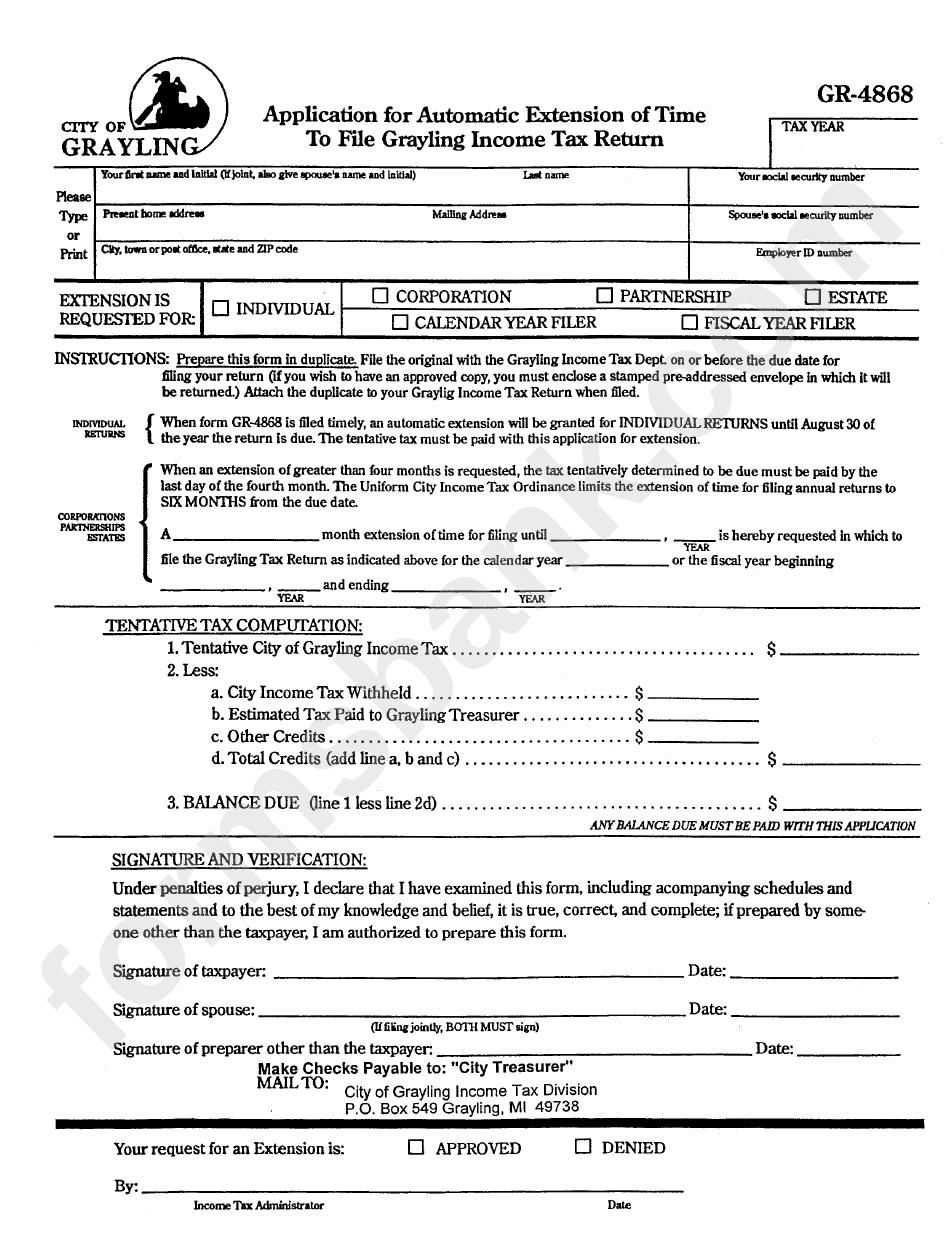

- Tax Extension Form | Editable PDF Forms

- tax extension » Refund Wise Tax

- Printable Tax Extension Form

- Is Filing an Extension a Bad Thing? What Do I Need To Know About Tax ...

Why File a Tax Extension?

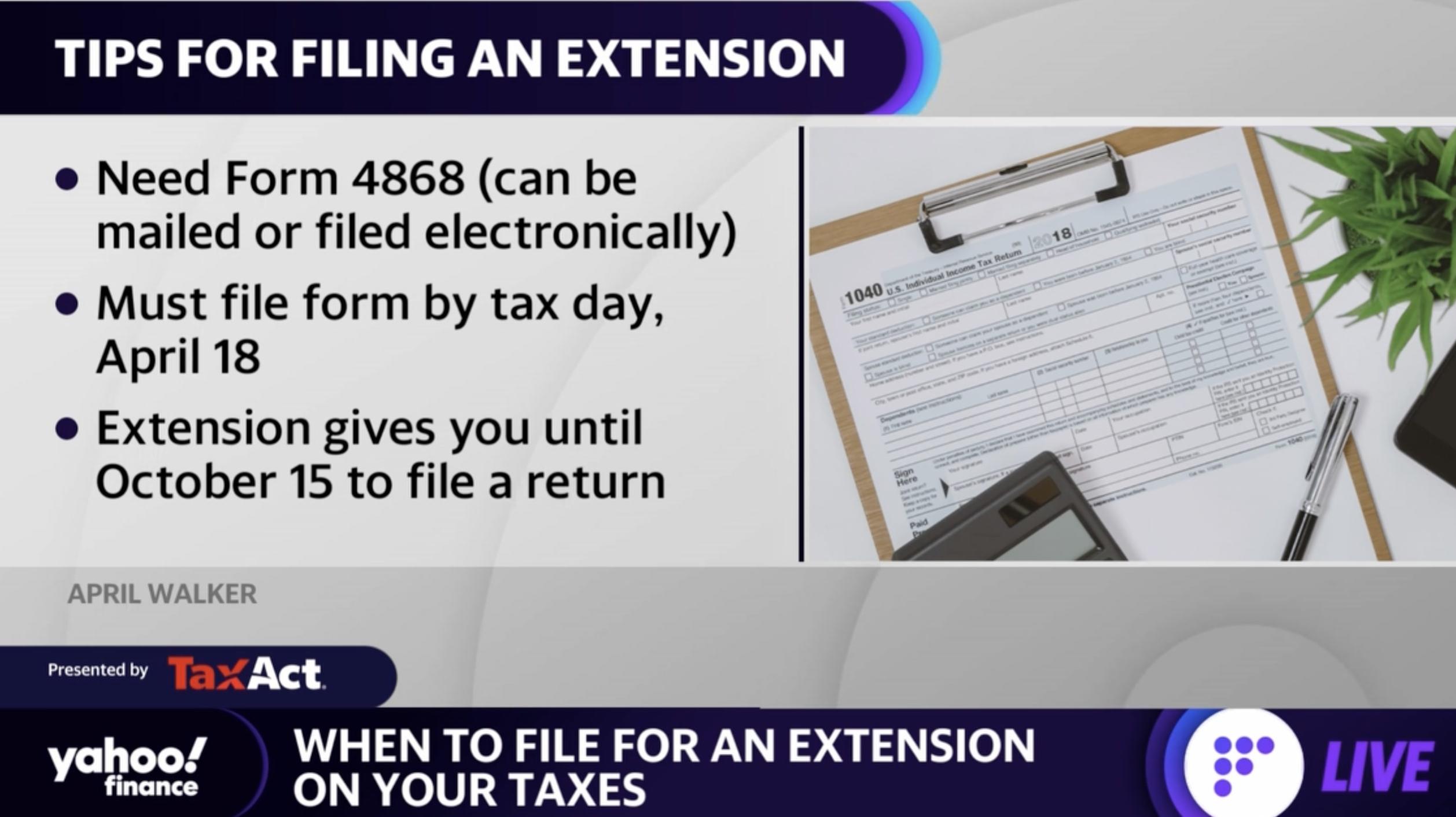

How to File a Tax Extension

What to Do After Filing a Tax Extension

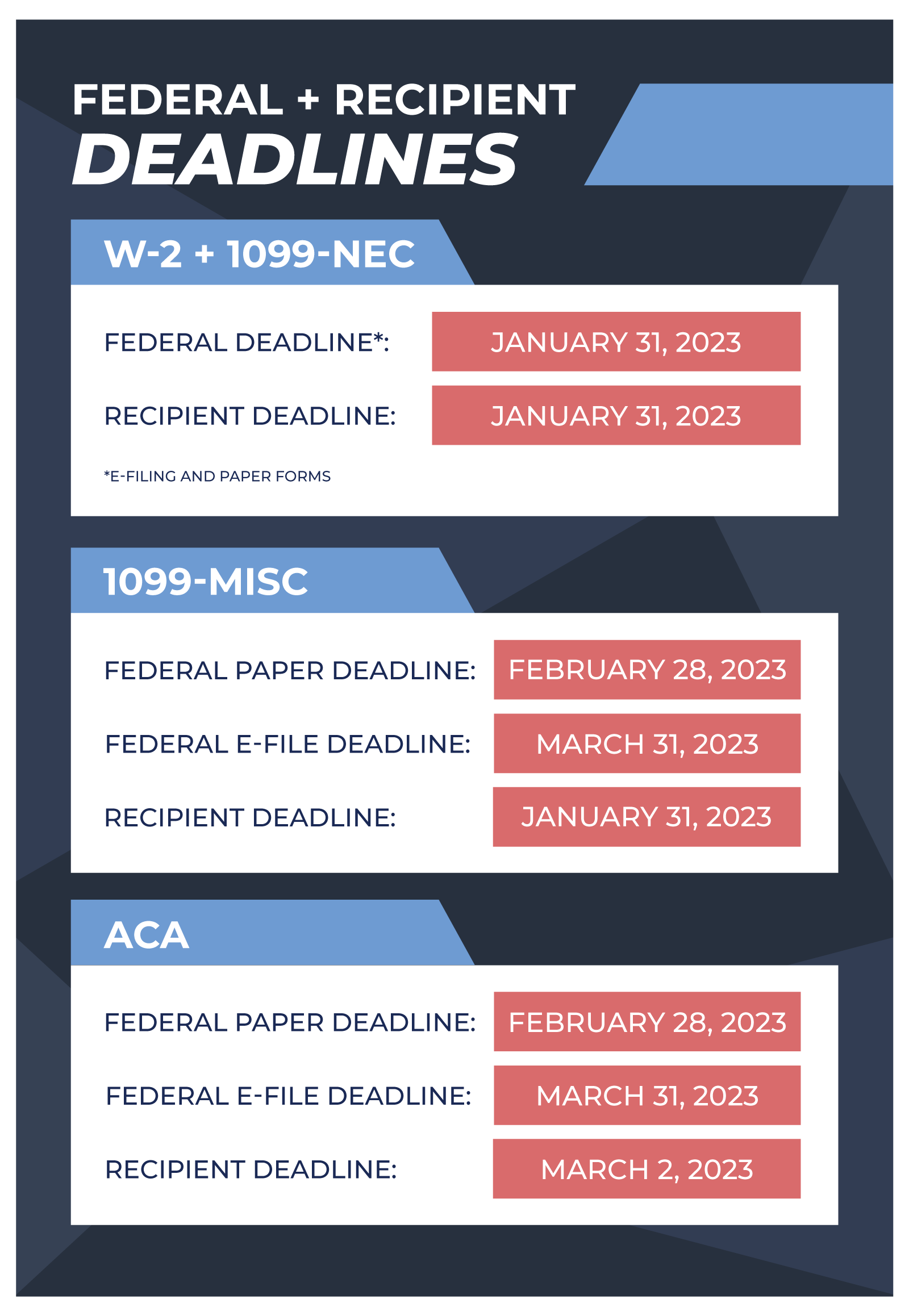

Once you've filed a tax extension, you'll have until October 15 to submit your tax return. Use this extra time to: Gather all necessary documents, including W-2s, 1099s, and receipts. Resolve any tax-related issues or disputes. Consult with a tax professional, if needed. Review and finalize your tax return to ensure accuracy.

Important Reminders

An extension to file is not an extension to pay. If you owe taxes, you'll need to make a payment by April 15 to avoid penalties and interest. The IRS offers an automatic six-month extension, but you can also apply for an additional four-month extension in extreme circumstances. Keep a record of your extension filing, including the confirmation number or mailed receipt. In conclusion, filing a tax extension can be a lifesaver for those struggling to meet the April 15 deadline. By following the steps outlined in this article, you can ensure a smooth and stress-free experience. Remember to use the extra time wisely, and don't hesitate to seek professional help if needed. Beat the clock and file your tax extension today!For more information on tax extensions and other tax-related topics, visit the IRS website or consult with a tax professional. Stay ahead of the tax deadline and ensure a hassle-free tax season.

Note: The word count of this article is approximately 500 words. The HTML format is used to make the article SEO-friendly, with headings, bold text, and links to enhance readability and search engine ranking.